Here’s a comprehensive blog post on “Best Blockchain Projects Beyond Crypto”, focusing on real‑world use cases and enterprise applications — and what they mean for the future.

# Best Blockchain Projects Beyond Crypto

While many discussions around blockchain focus on cryptocurrencies, the real potential of blockchain lies in use cases outside mere token speculation — in supply chains, identity, enterprises, data‑sharing and more. Below are some of the most compelling blockchain projects (or networks) that are worth watching because they focus on practical utility rather than just crypto‑value.

Key Projects to Watch

Here are several blockchain initiatives that are doing something meaningful beyond “just a new coin”.

1. Hyperledger

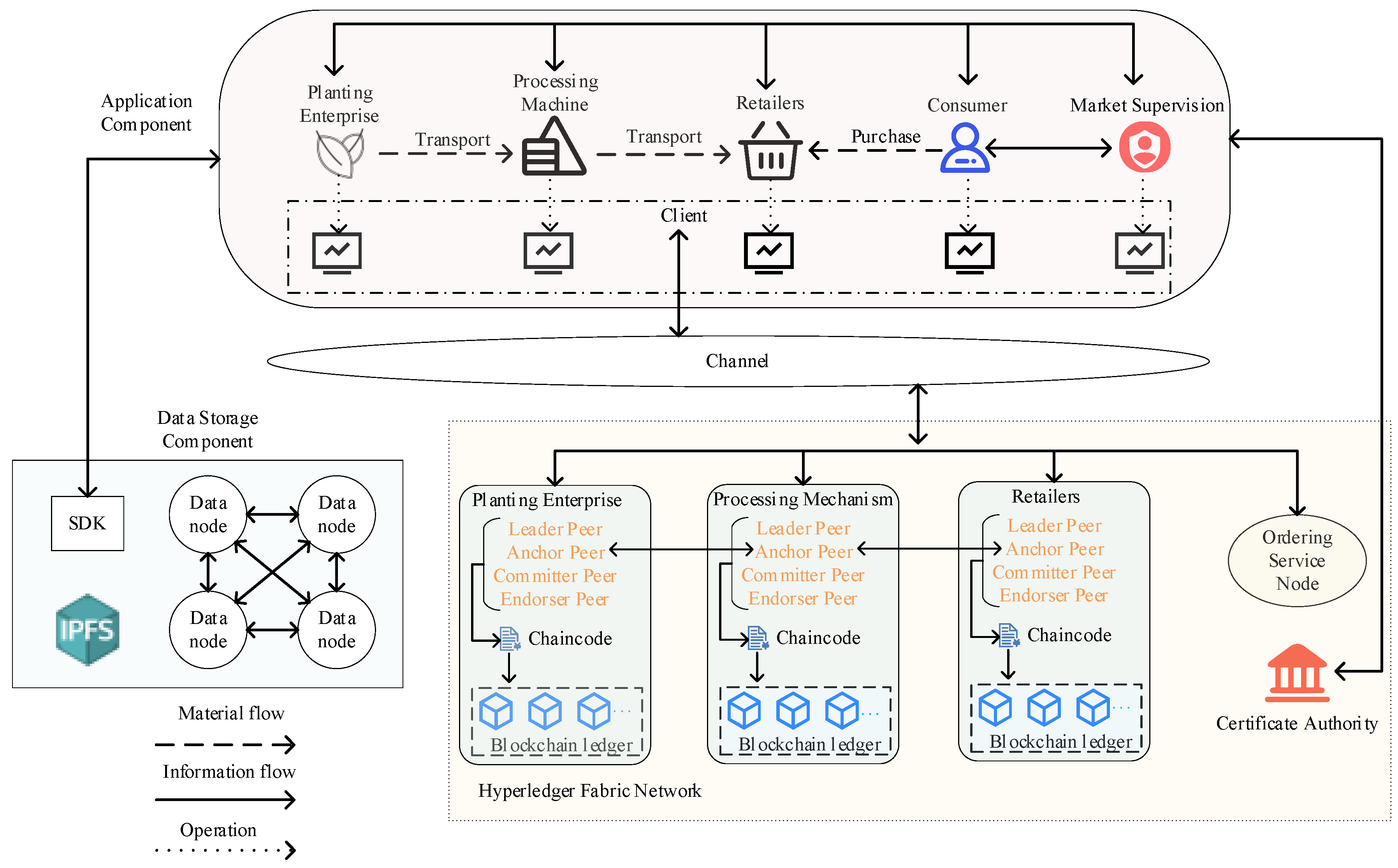

What it is: Hyperledger is a global enterprise blockchain project under the Linux Foundation, providing frameworks, standards and tools for permissioned (private/consortium) blockchains. (Investopedia)

Why it matters: It is explicitly built not around launching a cryptocurrency, but enabling companies to deploy blockchain solutions for business processes (e.g., supply chain, identity management).

Use cases: Any enterprise needing auditability, trust across multiple parties and immutable records—e.g., supply chain provenance, manufacturing, trade‑finance.

Takeaway: If you’re looking for blockchain beyond crypto, Hyperledger is a foundational infrastructure worth knowing about.

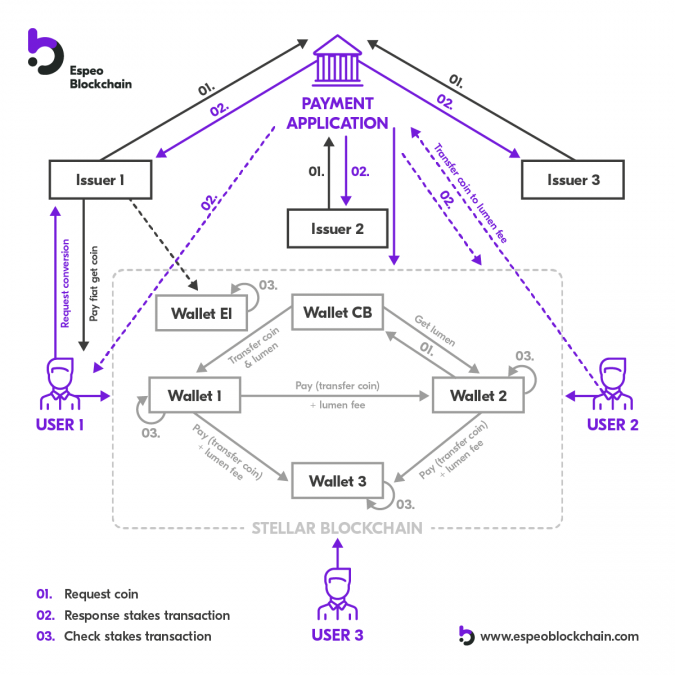

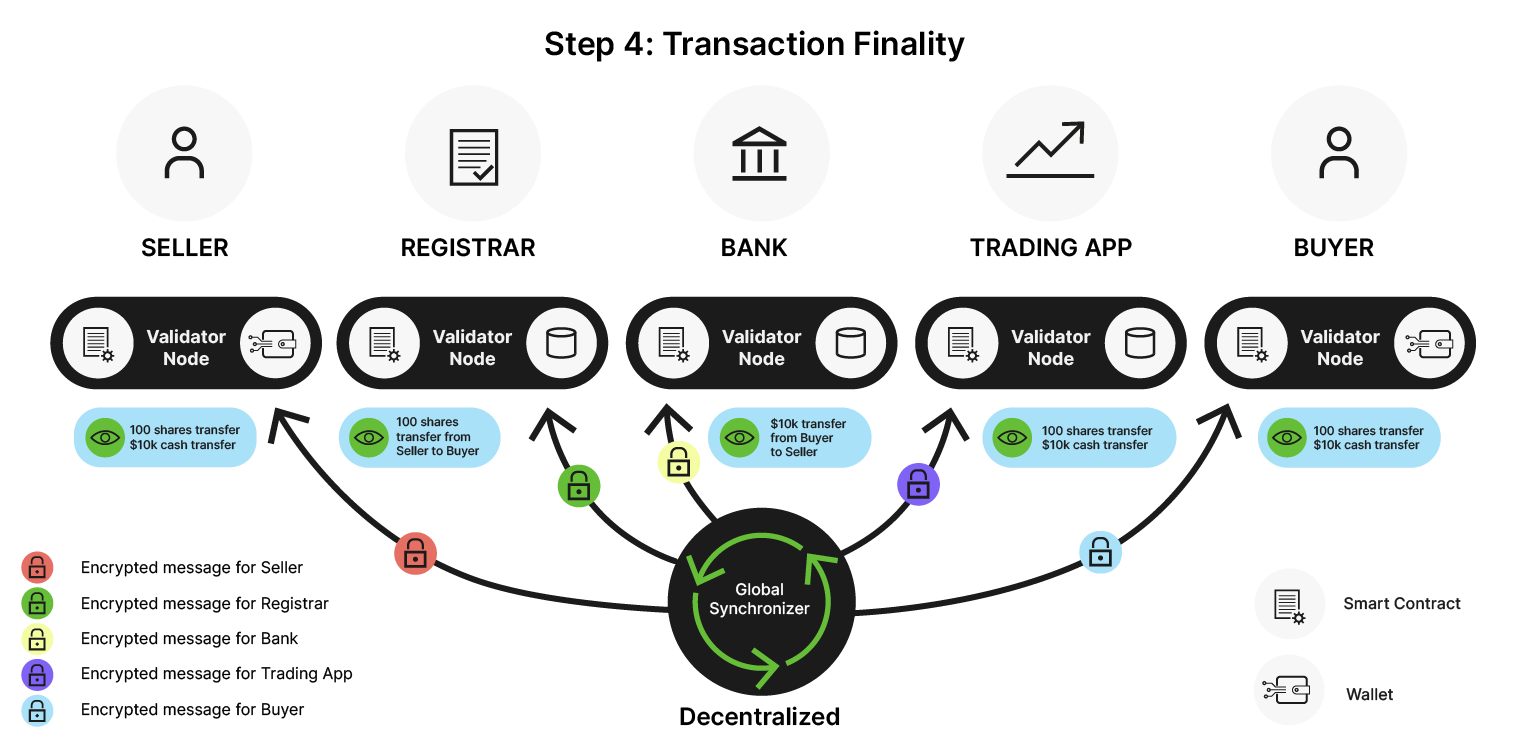

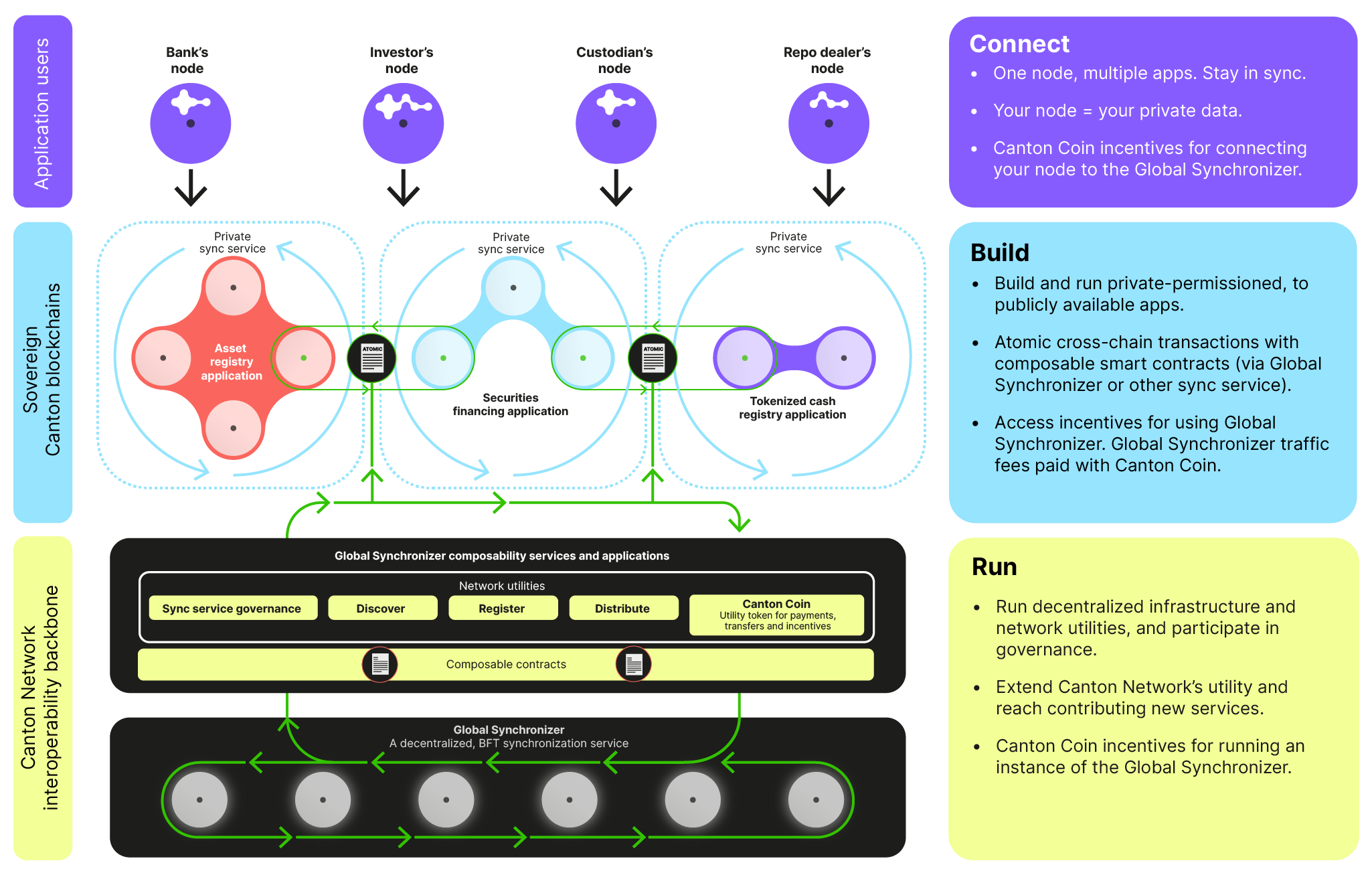

2. Canton Network

What it is: The Canton Network is a public blockchain network developed to enable regulated financial institutions to transact across multiple systems while preserving privacy and interoperability. (Vikipedi)

Why it matters: It shows that major banks and institutions are deploying blockchain for real‑world assets, tokenisation and settlement processes, not just crypto speculation.

Use cases: Tokenisation of gold, eurobonds and other financial instruments; cross‑market settlement; bridging legacy finance with blockchain.

Takeaway: Blockchain as infrastructure for Finance‑as‑a‑Service—and not just digital currencies.

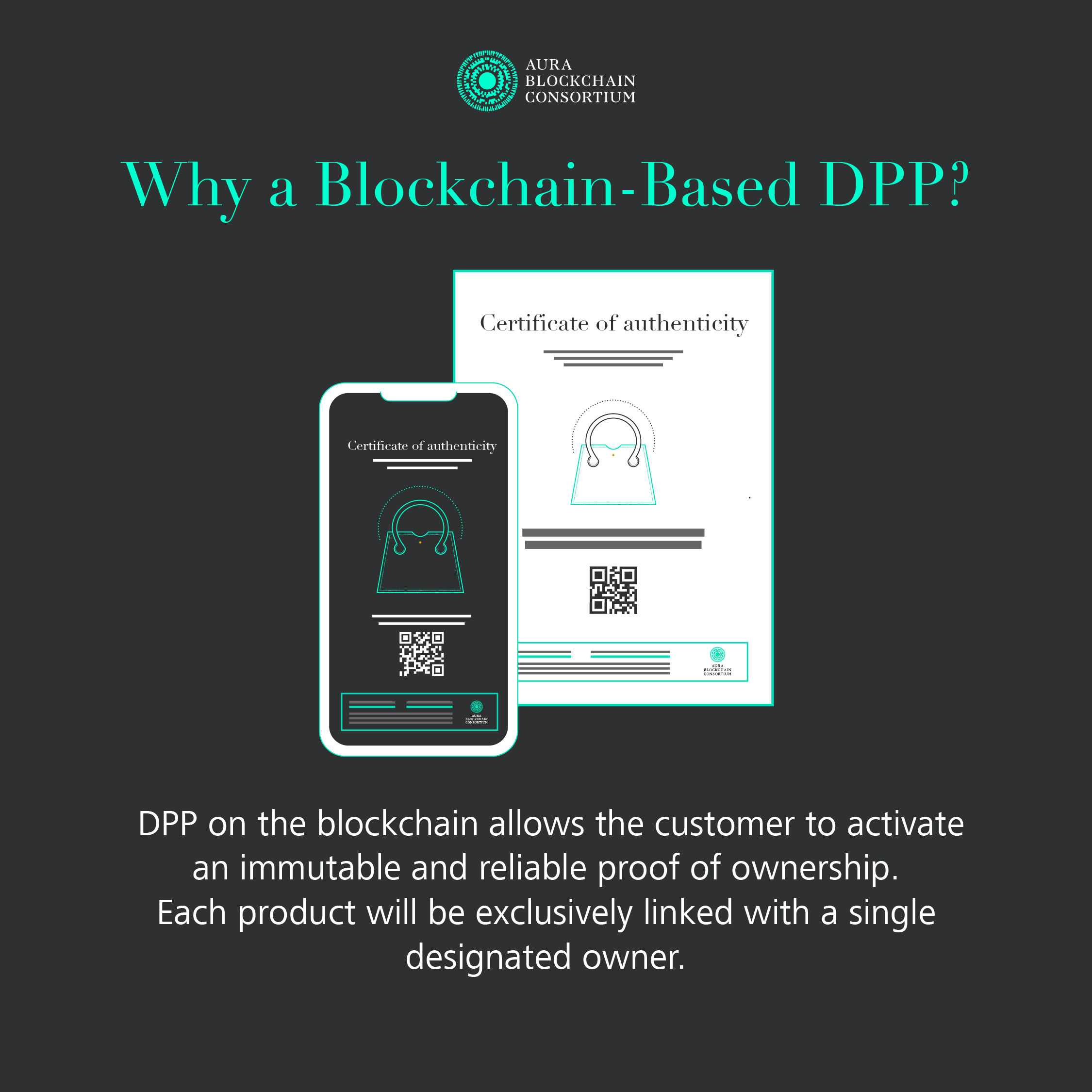

3. Aura Blockchain Consortium

What it is: Aura is a blockchain‑based initiative by luxury brands (e.g., LVMH, Prada, Richemont) focusing on product transparency, provenance and anti‑counterfeiting. (Vogue Business)

Why it matters: It’s a strong example of blockchain being used for luxury goods tracking, authenticity verification and sustainable supply chains.

Use cases: Digital product passports, tracking lifecycle of luxury items from production to retail, verifying authenticity for consumers.

Takeaway: Blockchain is no longer confined to finance or tech — it’s entering high‑value retail and supply‑chain domains.

4. Data / Industrial Applications

While not always one single project, many blockchain systems focus on data interoperability, secure identity, IoT and industrial use‑cases. For example:

- Projects that ensure secure car entry and autonomous vehicle data via blockchain. (shardeum.org)

- Systems for worker registration and anti‑forced‑labor tracking using blockchain. (shardeum.org)

Takeaway: The “beyond crypto” value often lies in how blockchain enables trusted data flows, multi‑party coordination and secure records across industries.

Why This Matters

- Enterprise adoption: These projects show that large institutions are deploying blockchain not as a gimmick, but as infrastructure.

- Diverse domains: From finance to luxury goods to identity and IoT — blockchain’s reach is broadening.

- Real‑world impact: The benefit isn’t just speculative gains but improved process efficiency, trust, compliance, transparency.

- Less hype, more utility: By moving away from “coin value” headlines, these projects focus on solving tangible problems.

Key Challenges & Considerations

- Interoperability and standards: Many blockchains still operate in silos; cross‑chain and ecosystem coordination remains hard.

- Regulation & governance: When dealing with real assets (gold, bonds, identity), regulatory compliance becomes critical.

- Scalability & cost: Enterprise grade blockchains must handle large scale without prohibitive cost or latency.

- Business model clarity: Utility must translate into value—stakeholders must see what the blockchain brings beyond the “buzz”.

- Adoption friction: Legacy systems, stakeholder buy‑in and integration often slow down rollout.